November 01, 2017

Report Gambling Winnings On 1040

Have you recently won some cash at the casino or racetrack? Congratulations! While it is very exciting, keep in mind there are tax implications and you should be prepared to pay federal, state and local income taxes on the winnings.

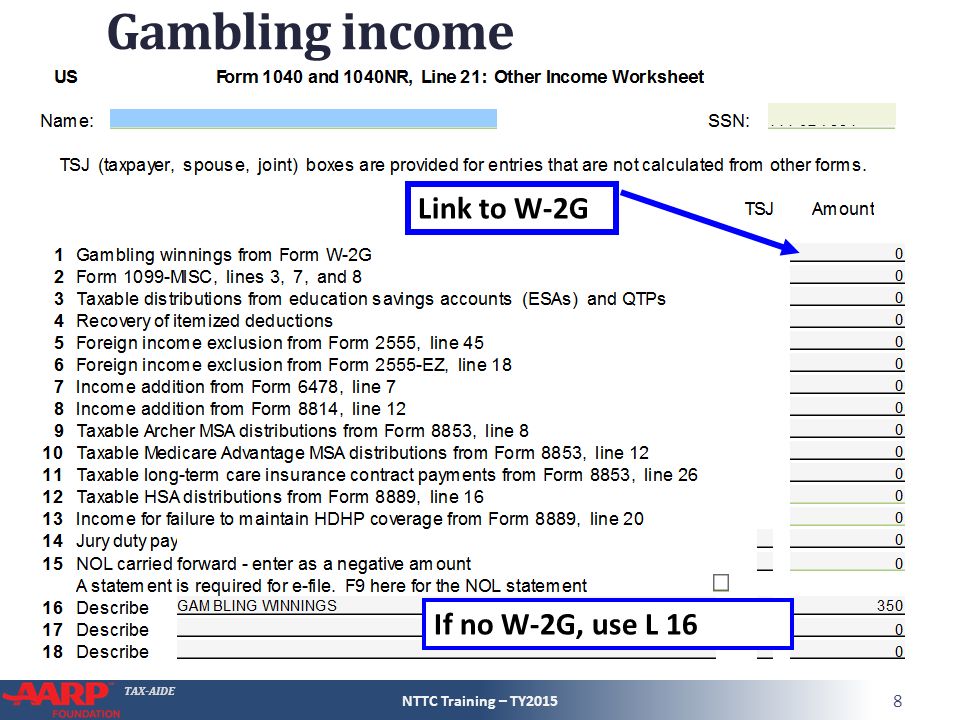

Reporting Tax on Winnings Taxes on Prize Money and Sweepstakes Winnings. Typically, tax on winnings, like sweepstakes or prize money, should be reported to you in Box 3 (other income) of IRS Form 1099-MISC. This includes winnings from sweepstakes when you did not make an effort to enter and also applies to merchandise won from a game show. You must report all gambling winnings as 'Other Income' on Form 1040 or Form 1040-SR PDF (use Schedule 1 (Form 1040 or 1040-SR) PDF), including winnings that aren't reported on a Form W-2G PDF. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

You can anticipate that the casino or other party that provides the payout to give or send you a Form W-2G. The information reported on this federal form includes the date you won, the reportable winnings, type of wager, federal and state taxes withheld and other details about the transaction.

You will file a W-2G if you won money from any of the following sources (please note, the list is not exhaustive):

- Horse/dog track or off track betting

- Jai-alai

- State-conducted lottery

- Keno • Bingo

- Slot machines

- Poker winnings

- Any other type of gambling winnings

Keep in mind, even if you win money at a charity event that is hosted by a church or other type of non-profit organization, those winnings are taxable. If you paid money to participate in the event, such as purchased cards for a game of bingo at your church, you cannot claim the funds you spent as a donation to a non-profit organization when you file your income taxes.

Have you recently won some cash at the casino or racetrack? Congratulations! While it is very exciting, keep in mind there are tax implications and you should be prepared to pay federal, state and local income taxes on the winnings.

Reporting Tax on Winnings Taxes on Prize Money and Sweepstakes Winnings. Typically, tax on winnings, like sweepstakes or prize money, should be reported to you in Box 3 (other income) of IRS Form 1099-MISC. This includes winnings from sweepstakes when you did not make an effort to enter and also applies to merchandise won from a game show. You must report all gambling winnings as 'Other Income' on Form 1040 or Form 1040-SR PDF (use Schedule 1 (Form 1040 or 1040-SR) PDF), including winnings that aren't reported on a Form W-2G PDF. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

You can anticipate that the casino or other party that provides the payout to give or send you a Form W-2G. The information reported on this federal form includes the date you won, the reportable winnings, type of wager, federal and state taxes withheld and other details about the transaction.

You will file a W-2G if you won money from any of the following sources (please note, the list is not exhaustive):

- Horse/dog track or off track betting

- Jai-alai

- State-conducted lottery

- Keno • Bingo

- Slot machines

- Poker winnings

- Any other type of gambling winnings

Keep in mind, even if you win money at a charity event that is hosted by a church or other type of non-profit organization, those winnings are taxable. If you paid money to participate in the event, such as purchased cards for a game of bingo at your church, you cannot claim the funds you spent as a donation to a non-profit organization when you file your income taxes.

If you find yourself on the losing end of a game of chance, you may wonder if you can report a gambling loss on your tax return. Generally, it is not allowable, but there are exceptions. It is advisable that you consult with a tax professional if you find yourself in such a situation or have questions.

Where Do I Put Gambling Winnings On 1040 Tax Form

For rules, laws and other information pertaining to gaming in Indiana, visit the Indiana Gaming Commission website at http://www.in.gov/igc/.